update STONEFRUIT WA

Call for

CHANGE

In today’s climate of scrutiny, we look past pricing to other issues that need attention for industry success.

Words Ross Anile, project officer

LAST year was an interesting year in which the horticulture industry faced many issues. Adverse weather phenomena and economic pressures from the supply chain post-Covid are just two. Now well and truly into 2024 and with conversations around price gouging and industry costs, I have pulled together a list of what we will be watching and where we will be expecting changes over the next 12 months. These challenging times require all industry partners and governments to work together to provide secure and sustainable food chain solutions.

Supply Chain Inflation

We have all heard the conversations about price gouging from the press and our political leaders. The discussion should be opened to include input cost inflation. Since the impact of covid, many growers have voiced their concerns on the rising input costs of production, while returns have stagnated to the point where current prices are equivalent to prices from 20 years ago. Over the past three-year period, the cost of all key horticultural inputs have increased significantly. Key areas of concern are: energy, fertilisers, labour and chemicals. Significant price increases have been experienced by farmers when purchasing fertilisers, which have increased by more than 100 per cent over the same three-year period. This is followed by chemicals, which have increased by 30 per cent to 50 per cent. Interestingly, most suppliers of chemicals, fertilisers and energy are either multinational or national enterprises, which are never scrutinised on why costs just keep increasing to the grower’s economic detriment. The result is many producers in Australia are likely to remain risk-averse due to the huge uncertainty they currently face.

“ We have all heard the conversations about price gouging from the press and our political leaders. The discussion should be opened to include input cost inflation ”

Supply = Demand

As the world faces a demand on resources which is finite, Digital Horticulture is coming to the forefront. Europe is leading the way in digital connectivity between growers, processors, distributors and retailers to achieve greater efficiencies through integrated communication platforms. This approach is enabling production to become more sophisticated, controlled and exact. With ever increasing costs of production and challenging returns, over-supply is economically unsustainable.

Logistics

Since the 1960s, the Suez Canal has been of grave concern to all shipping companies, world traders and governments. That narrow stretch of water can be easily closed to all shipping due to political unrest. Recently, the container ship Evergreen ran aground, which took six days to set free. The disruption to international trade was significant. Concerningly, we now face another logistical crisis in the Red Sea, and the increased activity by Somalian pirates. The 2013 World Bank study estimated that piracy cost the global economy $18 billion dollars annually. A guess-timate would envisage a figure of up to $50 billion dollars when also taking into account the Red Sea crisis over the 2024 financial year. With the increasing availability of airlines flying between Asia and Australia, opportunities exist to move more stonefruit into Asia by air. This will depend greatly on the airfreight rate per container verses sea freight rates. Australia is in a prime position to meet some of Asia’s fresh food requirements if these global transport crises impact trade from Europe/Middle East to Asia.

Climate change

We are constantly being reminded across all forms of media of the impact of extreme weather conditions globally. Currently both Chile and Australia are experiencing extreme heat, fuelling major fire events with loss of life and the scorching of millions of acres of vegetation. Then we have the extreme flooding on the east coast of Australia, which has impacted many towns and horticultural zones to the point that these areas are finding it difficult to provide produce for the eastern states. Since the 1980s, Australian farmers have invested in better water management techniques/systems to deal with the reduction of natural rainfall. This can be seen on orchards from the Perth Hills to the South West. The future requires further investment by orchards in computerised watering technology to utilise this finite resource in a more efficient manner, with government guidance and financial incentives. These challenging times require all industry partners and governments to work together to provide more secure and sustainable food chain solutions.

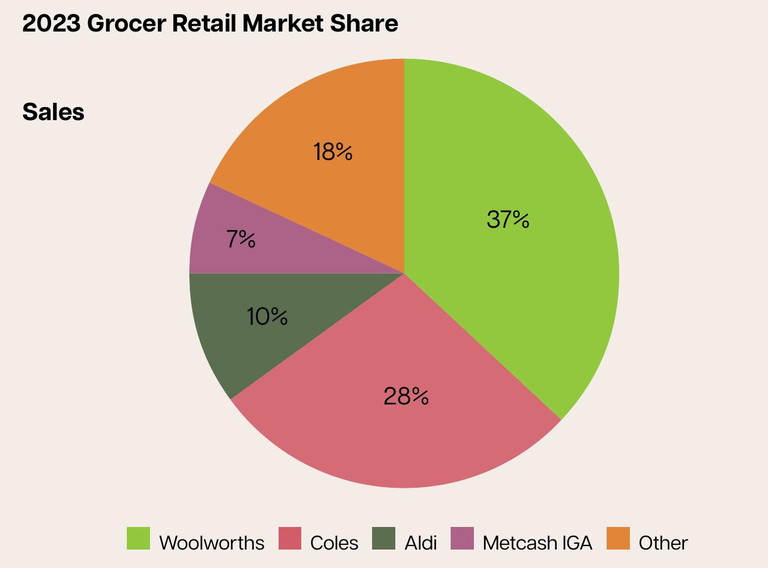

Time to talk

Small businesses, particularly farmers, within food supply chains have been let down by poor competition policy in Australia over the past 40 years. There has been a failure to address the significant imbalance of power afforded to industry partners at the expense of Australian farmers economic viability. The above pie chart shows the 2023 retail market share of all the major players in the Australian grocery market sector. Currently in Europe, farmers are voicing their concerns of economic viability by protesting on the major highways and in the major cities. To avoid a repetition of these types of protests in Australia, we need a concerted effort by government, farmers and industry partners to have that discussion and come up with a positive framework to ensure food security and sustainability for generations to come.